How Healthcare Shifts Affect MOB Investing

Healthcare is quietly undergoing one of the most important structural shifts of the last 20 years—and it has nothing to do with politics or reimbursement cycles.

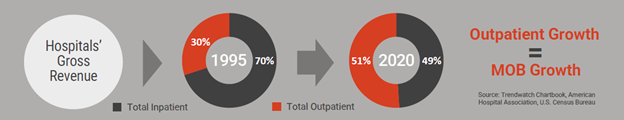

Over the last couple of decades, healthcare has been quietly but fundamentally changing where care is delivered. Many procedures that used to require a hospital stay are now routinely done in outpatient settings, often inside medical office buildings (MOBs). Orthopedics, imaging, cardiology, oncology, and even certain surgical procedures have moved out of the hospital and closer to where patients live and work. This isn’t a temporary trend driven by economics or policy cycles—it’s a structural shift in how healthcare operates.

What is Driving the Shift?

A big driver of this change is cost. Hospitals are the most expensive place to deliver care, and insurers, Medicare, and Medicaid all have strong incentives to push treatment into lower-cost environments. Outpatient facilities are simply more efficient to run, and as healthcare continues to move toward value-based reimbursement, those efficiencies matter more every year. The system is rewarding care that is delivered safely, effectively, and at a lower cost, which naturally favors outpatient settings.

Technology has also played a major role. Advances in minimally invasive procedures, imaging, anesthesia, and recovery protocols mean patients no longer need to spend days in a hospital for treatments that can now be handled in a single visit. What once required inpatient care can often be completed in a few hours, with patients recovering in the comfort of their home the same day. As technology continues to improve, that list of outpatient procedures keeps growing.

Physicians themselves are another important part of the story. Many doctors prefer outpatient environments because they offer more control over scheduling, staffing, and patient care. Operating outside the hospital system can reduce administrative friction and, in many cases, improve medical practice economics. As a result, physician groups are increasingly choosing outpatient facilities, often anchored in well-located medical office buildings, as the core of their practices.

Patients are pushing this shift as well. Outpatient facilities tend to be easier to access, with simpler parking, shorter wait times, and lower out-of-pocket costs. People generally prefer care that fits into their day rather than disrupting their lives with hospital visits. Healthcare, like many other industries, follows consumer behavior, and patients have made it clear that convenience matters.

Why Investors Are Increasingly Turning to Medical Office Buildings

All of this directly benefits medical office building investors. As more care moves outpatient, MOBs become essential infrastructure rather than optional real estate.

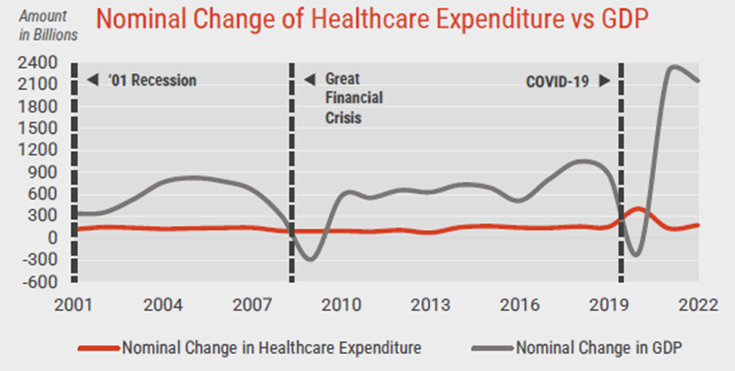

Demand is driven by long-term factors like aging demographics and increased healthcare utilization, not by economic cycles. People don’t delay medical care in the same way they delay discretionary spending, which helps support consistent occupancy and income. In other words, people don’t stop visiting doctors because the economy slows. Healthcare services remain essential regardless of economic conditions, which supports rent payment continuity even during downturns..

Medical tenants also tend to stay put. Their spaces are highly specialized, heavily regulated, and expensive to build out. Once a practice is established, moving locations is disruptive and costly, which leads to longer lease terms and lower turnover than traditional office properties. That stability is one of the reasons MOBs have historically produced more predictable cash flow.

On top of that, the supply of new medical office space is naturally limited. Development is constrained by zoning, healthcare regulations, and, in many markets, certificate-of-need laws. At the same time, rising construction costs make speculative development more difficult. When you combine growing demand with limited new supply, the fundamentals become very attractive for existing assets.

Perhaps most importantly, medical office buildings are insulated from many of the challenges facing traditional office. Healthcare delivery requires in-person interaction. It can’t be done remotely, and it isn’t subject to work-from-home trends. That has allowed MOBs to remain resilient while other office sectors have struggled.

The Bottom Line

For investors, the takeaway is straightforward. The shift from hospitals to outpatient care is reshaping healthcare real estate, and medical office buildings are at the center of that transformation. They offer durable demand, long-term tenancy, and lower volatility, making them a compelling option for investors looking for stability and consistency in their real estate portfolios.

The Carlton Lane Advantage:

Family office expertise without the cost or complexity.

We combine institutional diligence, tax efficiency, and personal attention, empowering you with the sophistication of a family office—without the need to build one yourself.

We provide:

- Access. Proprietary deal flow curated from institutional networks.

- Oversight. Independent due diligence and post-investment monitoring.

- Alignment. We invest alongside you in select offerings.

- Transparency. Clear reporting, investor dashboards, and K-1 coordination.

- Execution. Concierge onboarding, back-office administration, and distribution management.