- Home

- I

- CL TKVA Access Fund

CL TKVA Access Fund

The Fund lends money to necessity based real estate projects that underpin daily life, mobility, and economic activity. These investments are designed to perform across market cycles, delivering predictable cash flow, downside protection, and long-term durability.

Overview

This Fund offers short-term, small-balance financing (previously serviced by banks) that provides attractive, stable current income to investors.

The Fund will focus on lending solutions for single-tenant NNN real estate operators and developers with substantial real estate collateral occupied by creditworthy tenants. The majority of these loans will be construction loans for build-to-suit NNN-leased properties.

Portfolio diversification is managed through geographic exposure, sector allocation, tenant selection, loan size, and property type.

Images shown are not guaranteed to be included in this fund and are for representation only.

The CL TKVA Access Fund LLC is an SPV created as a feeder fund to the Master Fund, Tikova U.S. CRE Debt Fund, LP, a private credit debt offering by Tikova. This private credit fund is typically reserved for institutional investors, including sovereign wealth funds, insurance companies, and large family offices. The CL TKVA Access Fund has a $100k minimum investment, compared to the Master Fund's current $1 million minimum.

Value Proposition

As interest rates have risen and the money supply has tightened, banks have grown more selective in their lending. A significant shift of deposits from banks to higher-yielding money market funds has reduced the reserves banks hold on hand. Because of regulatory reserve requirements, this decline in reserves limits banks' ability to extend credit — even to strong borrowers.

While credit quality remains important, many institutions are lending less across the board, not necessarily due to increased risk, but rather because of structural constraints in the current financial environment. This current market shift is creating a multi-year opportunity in the real estate debt market for CRE lenders with capital to deploy.

Key Benefits

- UBIT free option for IRA Fund

- Access to the institutional private credit space

- Access to a fund that has a $1M minimum investment

- Each loan has a floor interest rate in the 10% -11% range

- Loans are primarily in first lien positions

Target Returns

- Estimated IRR of 13-15%*

- Approximately 75 - 90% generated from current yield*

- Current income estimated to be 8%-12%*

- Income is paid quarterly

Investors must be Qualified Clients with a net worth of $2.2M or greater.

* Target net returns assume fund-level leverage. There is no guarantee that the target returns will be achieved, and actual returns and performance may be materially different than the target returns.

**For more detailed terms please contact us to receive the PPM.

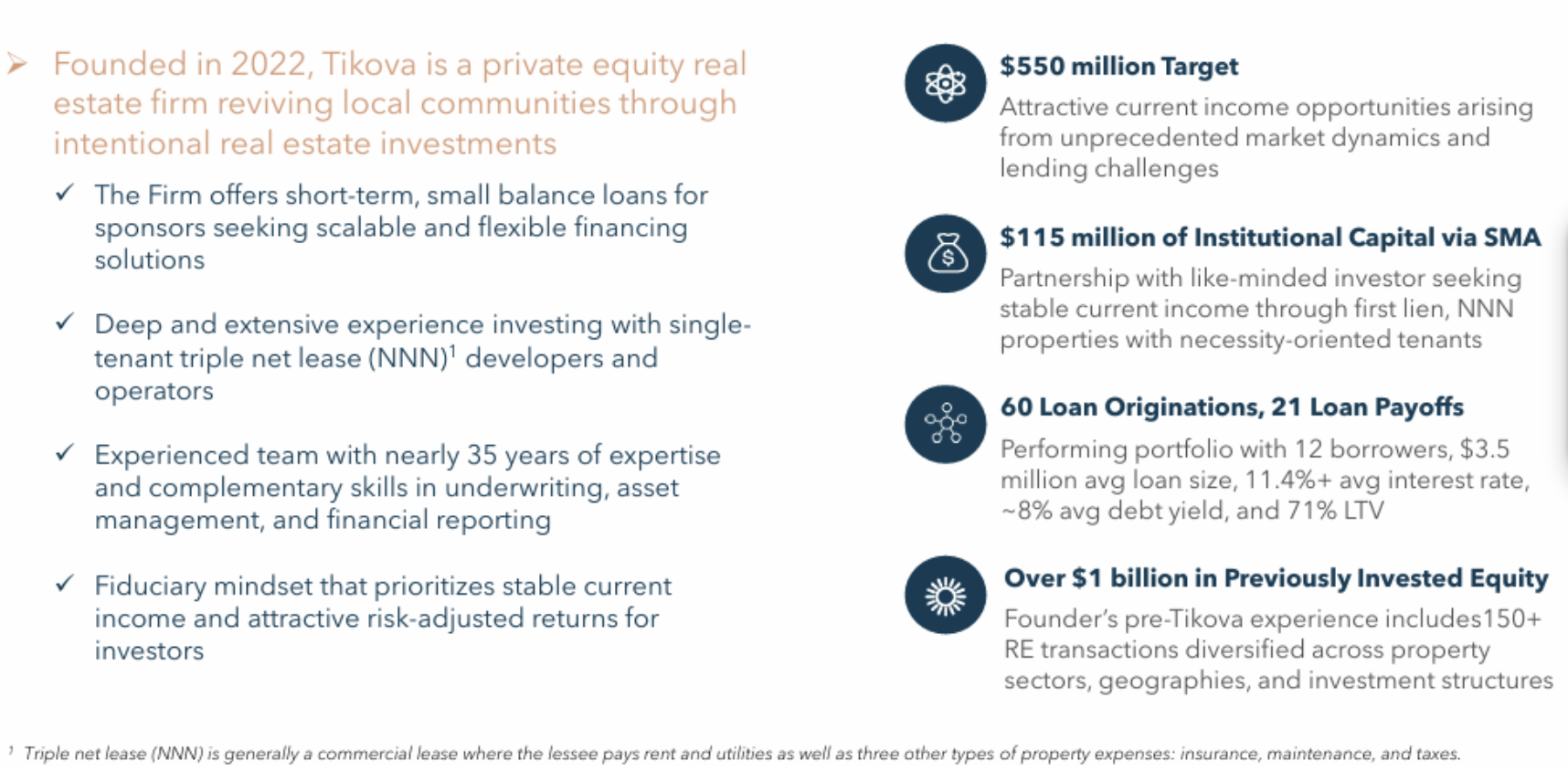

About The Sponsor - TIKOVA